Hi First name,

If not for outside interference, Unicoins would be trading at over $10/ú today.

That means 70,000 people who received free coins would be sitting on $1,000 in pure profit, with zero risk.

I shared this opinion with an investor recently when asked about the impact of the SEC’s actions against us. The SEC succeeded in crashing the value initially, but the game has changed. With the SEC now classifying most crypto assets as non-securities, the door is open for the Unicoin Foundation to rebuild the value.

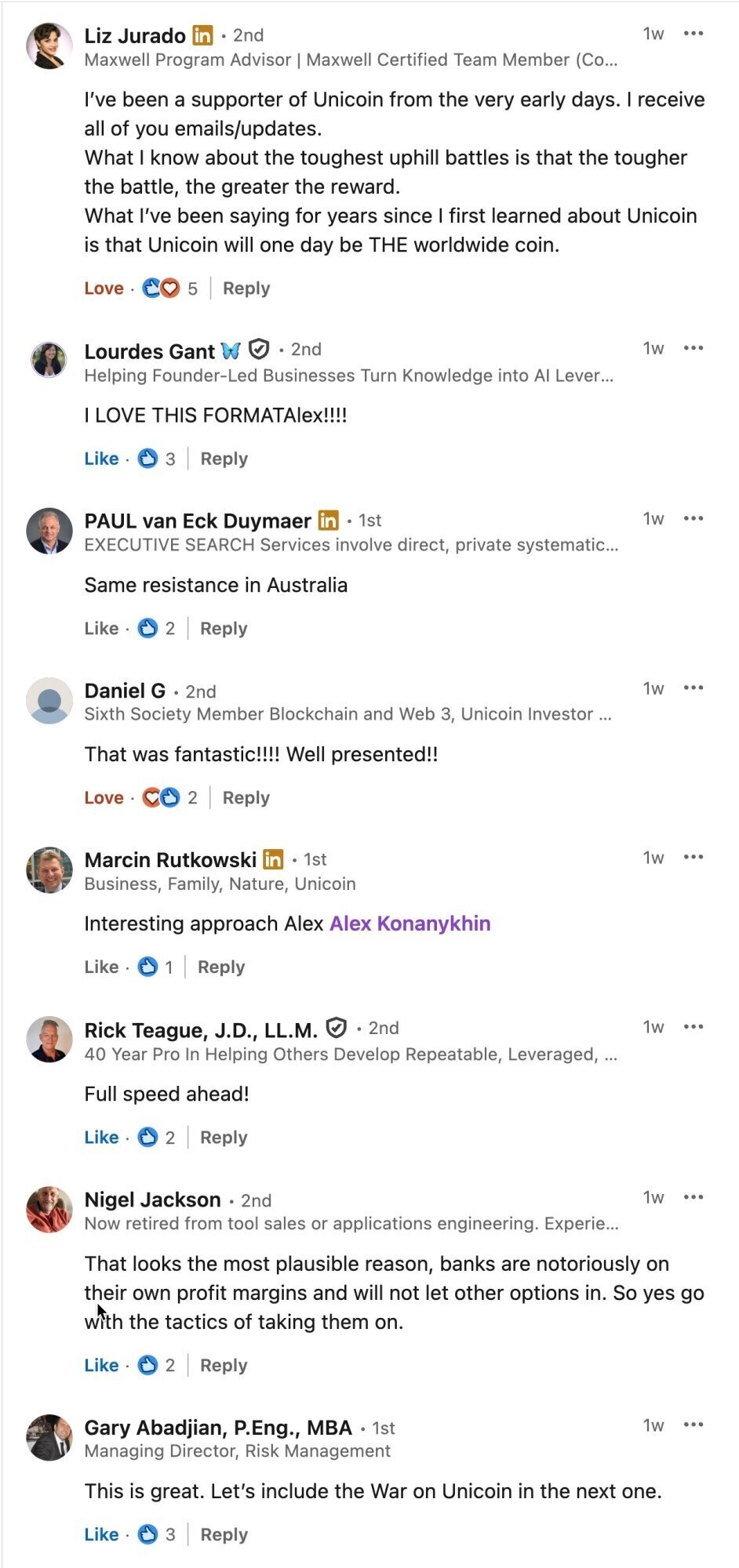

I recently asked our community for feedback on our mockumentary, and the support was near-unanimous:

Only a few people objected, advising “not to poke the bear.”

A wise advice. When you are dealing with a sleeping bear. Hardly applicable to the situation where the bear is trying to maul you.

I strongly believe in the value of clear communication. Almost every business day, I’m sending you updates in which I talk about our opportunities, strategies, risks, challenges, problems and successes.

Now that we are transitioning Unicoin to the new business model, necessitated by the November 12 Statement of the SEC Chairman, I deem it essential to expain to our investors and the potential new users of unicoins, what was so revolutionary about Unicoin that the SEC made it the final target of its notorious War on Crypto, how Unicoin had become the central remaining case of the battle for the Future of Money, and what makes it possible for Unicoin to succeed nonetheless.

This is why I described our story in my book, UNICOIN: War on Crypto & Future of Money.

And this is why we are presenting our story in a concise and entertaining format of a mockumentary for those who don’t have time to read the detailed version.

I’ll discuss these reasons in more detail in my next updates. The last business week of 2025 is starting and I have a busy Monday ahead of me, so I’ll end this update by returning to the conversation that I mentioned at the beginning of this update.

Having watched the first three scenes of our mockumentary, one investor asked me what be the price of unicoins would be by now if not the lawfare attack from the SEC.

I firmly believe that it’d be over $10/ú.

The price investors were paying for unicoins grew by 7,500% within two years from its launch at 1¢/ú in February of 2022.

We correctly identified a vast market opportunity – to create a strong cryptocurrency brand with lasting power and to deploy a blockchain greatly superior to Bitcoin.

We outperformed all other cryptocurrencies in pre-ICO fundraising.

With over $3B of “real estate for unicoins” swap agreements, and $18.7B of pre-public valuation, we were well-positioned to become the first publicly traded cryptocurrency company in the USA.

As the only audited and publicly reporting cryptocurrency company in the USA, we’d be a superior choice for institutional and traditional investors, with more than sufficient resources to deploy the ultimate blockchain.

We launched a high-visibility advertising campaign which would have surely made Unicoin a leading cryptocurrency brand by the end of last year.

And that is what made the SEC want to destroy us through gross abuse of power, annihilating the value of the investment of thousands of people.

Fortunately, the SEC is now stepping away from regulating cryptocurrency, with very narrow exception to which Unicoin will not belong. So, Unicoin Foundation has a chance to achieve great success.

That was my response to the investor who wanted to know where Unicoin would have been and where it can still grow to.

Let me conclude with obvious disclaimers: Success is never guaranteed. Risks are a factor in every business. Unicoin Inc. will not be providing “essential managerial efforts,” its shareholder voted to transfer those to Unicoin Foundation, which is currently being incorporated.

With very best wishes,

Sincerely,

P.S.: My updates focus on our journey towards becoming a publicly-traded company and on our efforts to turn our Unicoin into a major cryptocurrency. These updates are not intended to serve as financial advice or to replace our official reports filed with the SEC. Please note that I cannot possibly answer all the questions myself, so your response to this message may be processed by members of our Investor Relations team. “Unicoin USA” term is occasionally used for Unicoin Inc., a Delaware corporation. My past updates can be found at u.site/updates

Copyright © 2025 Unicoin, Inc., All rights reserved.

Our mailing address is:

228 Park Ave South, #16065, New York, NY 10003, USA

Our mailing address is:

228 Park Ave South, #16065, New York, NY 10003, USA

You received this email because you subscribed to our list.

You can unsubscribe at any time.